Keep Score: Understand the Balance Sheet for Small Business

What Is a Balance Sheet?

A balance sheet for a small business is a financial statement that shows a company’s assets, liabilities, and equity at a specific point in time. It gives an overview of a company’s financial position and is often used in conjunction with the income statement and cash flow statement to understand the company’s financial performance over a period of time. The balance sheet is divided into two sections: assets on one side and liabilities and equity on the other. The difference between the two sides is known as the company’s net assets or shareholders’ equity. The balance sheet assesses a company’s liquidity, solvency, and profitability.

Balance Sheet Structure

The balance sheet typically structures in the following format:

1. Assets: This section lists all of the company’s resources that have monetary value, including cash, accounts receivable, inventory, investments, property, and equipment. These assets are listed in order of liquidity, with the most liquid assets listed first.

2. Liabilities: This section lists all of the company’s debts and obligations, including accounts payable, loans, and taxes owed. These liabilities are also listed in order of maturity, with the most short-term obligations listed first.

3. Equity: This section represents the residual interest in the assets of the company after liabilities are deducted. The equity section includes common stock, retained earnings, and other capital accounts.

The total assets must equal the total of liabilities and equity. The balance sheet is a snapshot of a company’s financial position on a specific date and it helps to understand how assets are financed, either by borrowing money (liabilities) or by using the company’s own resources (equity).

It’s also worth mentioning that the balance sheet is divided into two parts, the left side for assets and the right side for liabilities and equity. The assets side of the balance sheet lists all the resources a company owns and controls, while the liabilities and equity side of the balance sheet lists all the claims against the assets of the company.

How Can a Balance Sheet Be Useful for Your Small Business?

A balance sheet can be useful for a company in several ways:

1. Assessing liquidity: A balance sheet can help a company determine its short-term financial health by showing how much cash and other liquid assets it has available to meet its current obligations.

2. Measuring solvency: By showing a company’s liabilities as well as its assets, a balance sheet can be used to measure a company’s long-term financial health and its ability to meet its long-term obligations.

3. Determining profitability: By comparing a company’s assets to its liabilities and equity, a balance sheet can be used to assess a company’s profitability and its ability to generate profits.

4. Identifying trends: By comparing balance sheets from different periods, a company can identify trends in its financial position and make necessary adjustments.

5. Planning for the future: In addition to giving an overview of the company’s current financial situation and resources, a balance sheet can be used to plan future investments and expenditures.

6. Making comparisons: Using a balance sheet, companies can compare their financial position with their competitors or industry averages, providing valuable information.

Overall, a balance sheet can provide a valuable snapshot of a company’s financial position and be a useful tool for making strategic decisions, monitoring performance, and assessing risk.

When Should a Small Business Utilize a Balance Sheet?

A company should utilize a balance sheet when the following factors occur:

1. When the accounting period ends: A balance sheet provides a snapshot of a company’s financial position at a specific point in time, usually at the end of each accounting period, such as the end of a quarter or year. This allows the company to see how its assets, liabilities, and equity have changed over the period.

2. Applying for loans or seeking investors: In order to assess creditworthiness and risk, lenders or investors often require a balance sheet as part of a loan or investment application.

3. Making strategic decisions: Companies can use balance sheets to make strategic decisions, such as identifying areas for cost cuts, determining how to invest in growth, or assessing merger and acquisition feasibility.

4. Assessing performance: As a company’s financial metrics, such as liquidity and solvency, change over time, its balance sheet can provide a quantitative assessment of its performance.

5. Communicating with stakeholders: Shareholders, creditors, and regulators need a balance sheet to understand a company’s financial situation.

Generally, a company should utilize a balance sheet as a regular part of its accounting and financial management process, to have a clear understanding of its financial position and to make informed decisions.

What Other Good Reasons Are There to Use a Balance Sheet?

Small businesses can find many other good reasons to take advantage of a balance sheet, such as:

1. Making informed decisions: By analyzing a balance sheet, you can make informed decisions about a business’s operations and growth, such as when to invest in new equipment.

2. Attracting investors: For small businesses trying to attract investors, their balance sheet provides a detailed overview of their assets and liabilities, which is crucial to assessing their creditworthiness.

3. Meeting legal requirements: Financial reporting and tax compliance for small businesses often require a balance sheet.

Largely, a balance sheet can be a valuable tool for small businesses to understand their financial position and make informed decisions to support their growth and success.

Balance Sheet for Small Business Summary

A balance sheet divides into two sections: assets on one side and liabilities and equity on the other. The balance sheet gives an overview of a company’s financial position in conjunction with the income statement and cash flow statement to understand a company’s financial performance over a period of time.

The assets section lists the company’s resources that have monetary value, such as cash, accounts receivable, inventory, investments, property, and equipment. The liabilities section lists the company’s debts and obligations, such as accounts payable, loans, and taxes owed. The equity section represents the residual interest in the assets of the company after liabilities are deducted. The equity section includes common stock, retained earnings, and other capital accounts.

It’s important to understand the different types of assets and liabilities and the difference between current and non-current assets and liabilities. Current assets represent assets that a company expects to convert into cash or consume within a year, while current liabilities represent obligations that are expected to be settled within a year. Non-current assets are assets that a company expects to hold for more than a year, while non-current liabilities represent obligations that are not due within a year.

The balance sheet also provides information about the company’s liquidity, solvency, and profitability. A company that has more assets than liabilities is in great financial health. Additionally, by comparing balance sheets from different periods, you can identify trends in key financial metrics such as liquidity, solvency, and profitability.

Overall, reading a balance sheet may take some practice, but with the proper understanding of the basics and the ability to interpret the numbers presented in it, it can be a valuable tool to understand a company’s financial position.

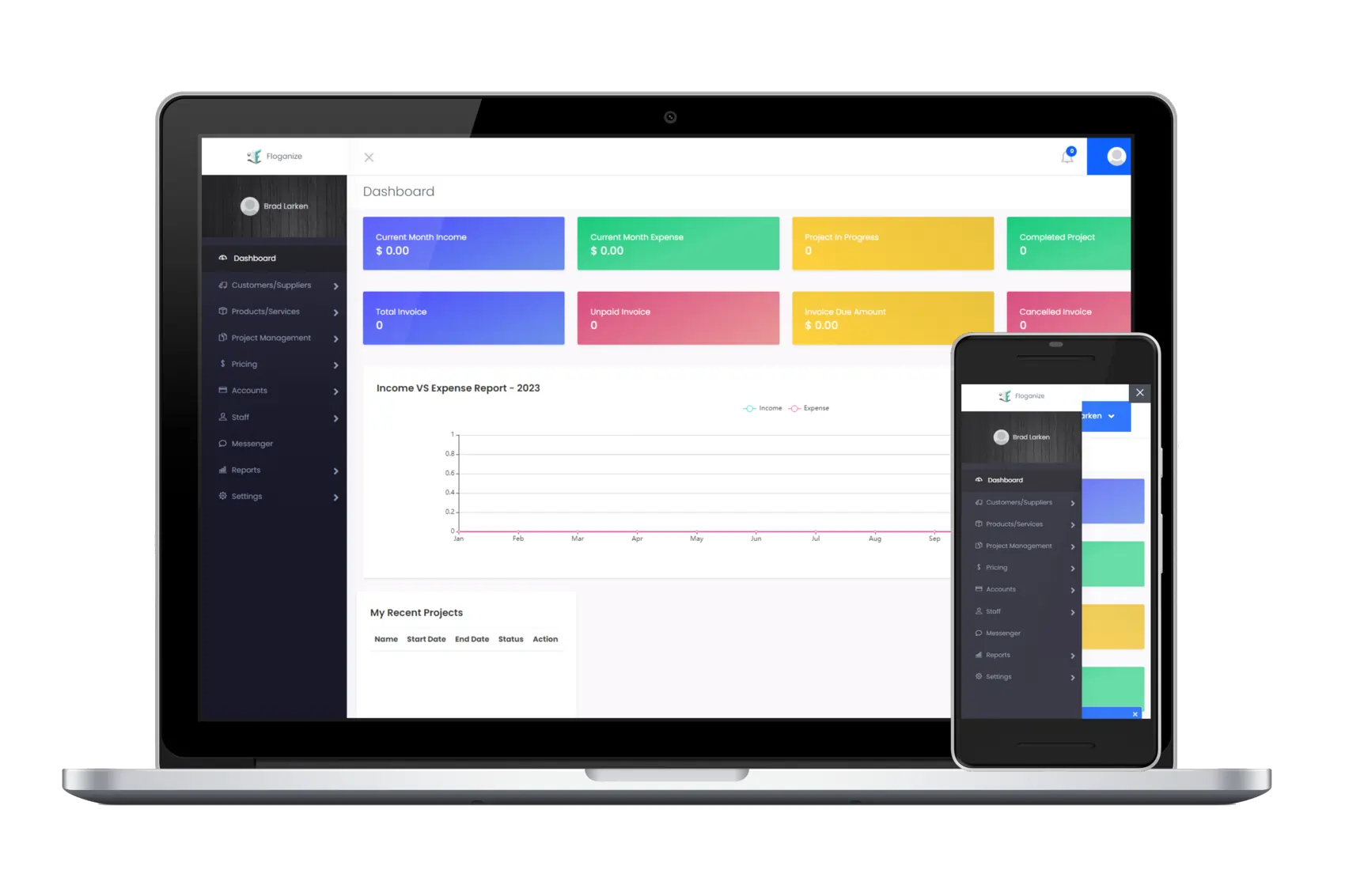

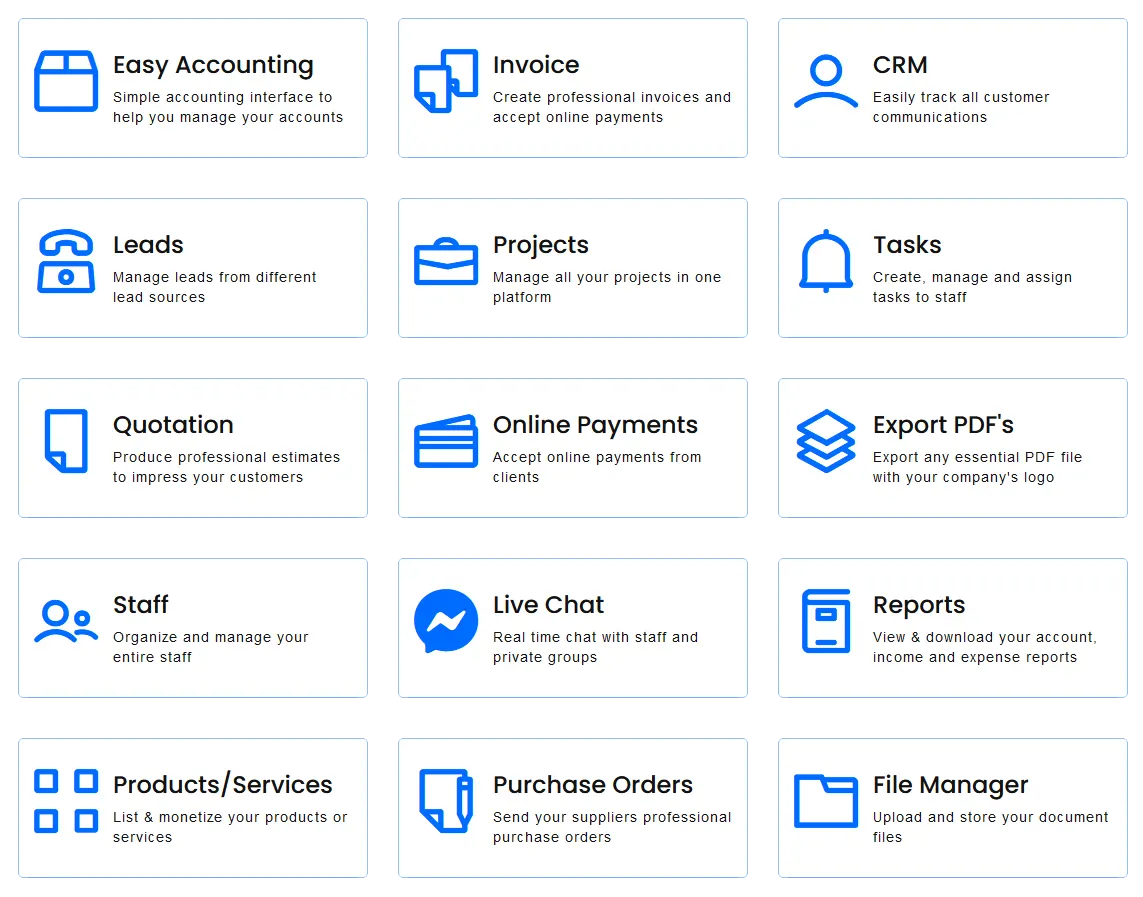

Floganize – The All-In-One Business Management Software

If you want to learn about our powerful business management software, then please click here to view the Floganize tutorials educational page. You can sign up today for a free 14-day trial! Simply click here and enjoy all of the powerful features that will simplify your daily business tasks!