The Importance of Key Results and Measurable Objectives

The following subjects will be discussed:

– Background information on OKR’s and a discussion of their significance

– How to develop quantifiable goals for accounting and finance

– How to develop quantifiable key results for accounting and finance

– Keeping track of and reporting on OKR’s

– Examples of real-world finance and accounting OKR’s

The Value of Measurable Goals and Key Outcome

The strategic planning and performance management systems of every organization should include objectives and key results (OKR’s). Organizations use OKR’s to gauge their progress and pinpoint opportunities for development.

An organization’s objectives are the particular aims it sets for itself, and its key results are the outcomes it expects to see as a result of achieving those goals.

Adopting OKRs can be a useful tool for gaining a clear understanding of where your firm is improving and where it needs to concentrate its efforts.

Using OKRs has advantages that include:

1. Objectives give the team members direction and motivate them to work harder to achieve their goals.

2. They assist in establishing the organization’s aspirational goals.

3. They aid management in monitoring progress and performing necessary adjustments.

4. They offer a structure for dialogue and teamwork.

5. They support performance evaluation and benchmarking against industry standards.

6. They nurture honesty and responsibility among all group members.

7. They assist in quantifying the effects of strategic choices.

When establishing your own OKR system, bear the following in mind:

1. Goals should be clear, measurable, and doable.

2. They need to be relevant to the mission and vision of the company.

3. They need to be regularly revised and updated.

4. They need to be in line with the goals and objectives of the business.

How to Develop Quantifiable Goals for Accounting and Finance

Having quantifiable goals in place is crucial when beginning a new project or carrying out any type of organizational transformation. The two basic categories of objectives are operational and strategic.

An organization’s broad goals are its strategic objectives. For instance, a business can set itself the strategic goal of dominating the market for financial services. On the other hand, operational objectives are particular targets that an organization sets in order to accomplish certain aims. For instance, a company’s operational goal can be to boost sales by 20%.

Once goals have been set, it’s crucial to monitor their advancement frequently. The objectives can then be modified to ensure that they are still relevant and useful once progress has been evaluated.

In general, goals are a crucial component of any organizational reform. Organizations can set goals that are doable and track their development by developing effective objectives.

How to Develop Quantifiable Key Results for Accounting and Finance

Setting defined financial goals and targets is crucial for producing quantifiable key results for the finance and accounting division.

The department’s aims and objectives should be reflected in the financial plan you make. The projected revenue, costs, and capital expenditures should all be included in this plan. To keep the strategy current and accurate, it should also be revised frequently.

Last but not least, it’s critical to make sure that the departmental staff members are aware of the financial aims and objectives and are making an effort to achieve them. Constant communication as well as training and seminars can help with this.

Here are some pointers to get you going:

1. Identify your main findings

You must first identify your primary outcomes. What specific indicators do you want to monitor and record? Include measurable key results that are relevant to your department when you are developing the goals and objectives for each department.

2. Examine the information

It’s crucial to assess the data after completing your key outcomes. This will enable you to pinpoint problem areas and monitor your development over time.

3. Establish performance standards

The next step is to develop performance criteria for each indicator after you have your main results. You can use this to monitor your progress and confirm that your main objectives are being reached.

4. Specify due dates

Don’t forget to establish due dates for each measure. You can monitor your progress and stay on course by doing this.

Keeping Track Of and Reporting on OKR’s

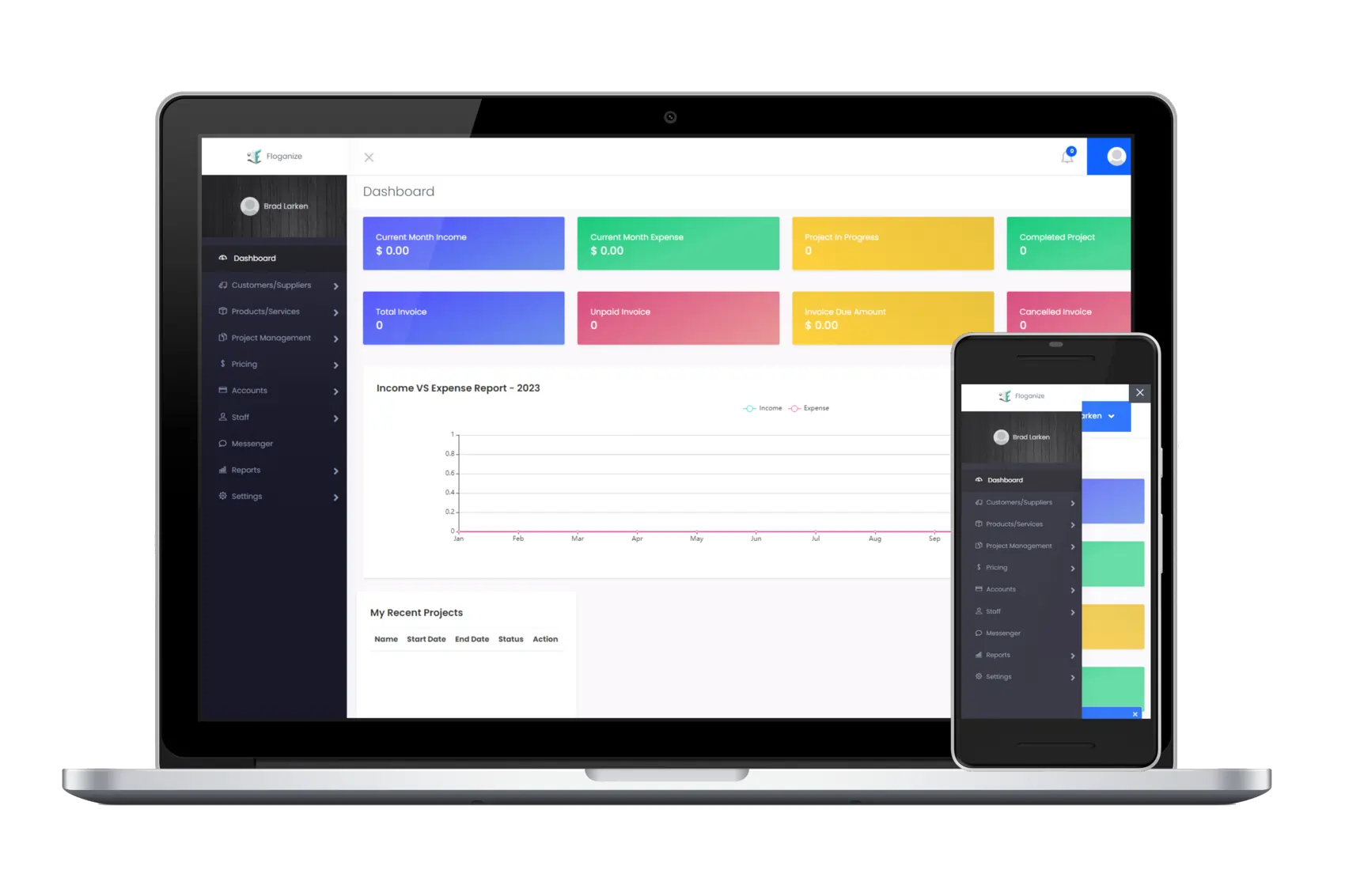

Monitoring and reporting OKR’s are done to keep track of progress and make sure that objectives are accomplished. A variety of methods can be used for monitoring and reporting. OKR’s may be followed both online and offline and can be monitored by using a spreadsheet or software.

List your organization’s strategic and operational goals for individuals, teams, and departments. This promotes collaboration, transparency, and teamwork in the pursuit of objectives.

Set a starting point, a goal, and a regular reporting schedule for the targets’ progress. View the progress and plot it on a timeline to help visualize the team’s goals.

Reports on significant results updates should be provided, together with comments on what was done to advance the targets at each reporting cycle. You may accomplish all of these objectives on one reliable platform with the aid of task management systems like Floganize.

Examples of Real-World Finance and Accounting OKR’s

There is no one size fits all approach to setting financial and accounting OKR’s; it depends on your organization. However, there are some recommendations for common OKR’s that you may use to help you perform better in the areas of finance and accounting.

– Setting objectives for a firm that makes athletic shoes may include boosting sales by 10% on a quarterly basis. Reaching sales goals each month, quarter, or half-year could be one of the key outcomes related to this objective.

– Setting objectives at a business that offers accounting services may include reducing costs by 15% on a quarterly basis. One of the key results for this objective could be the elimination of a certain area of expense or a 5% quarterly decrease in administrative spending.

– Setting objectives for a business that runs a restaurant can call for an annual 20% increase in profits. Achieving a specific amount of revenue each month or quarter could be one of the key results linked with this objective.

View the Floganize Tutorials Section to Learn More

If you want to learn more about our powerful business management software, then please click here to view the Floganize tutorials educational page. You can sign up today for a free 14-day trial! Simply click here and enjoy all of the powerful features that will simplify your daily business tasks!