Small Business Cash Flow Management Basics

We’ll concentrate on these points:

– The definition of cash flow

– The importance of cash flow

– Cash flow issues

– Cash flow management concept

– Cash flow monitoring and management

What is Cash Flow?

The quantity of cash or cash equivalents entering or leaving a business is known as cash flow. It is typically measured on a regular basis, such monthly or yearly. Depending on whether more money is coming in or leaving the organization, the cash flow can be either positive or negative.

The cash flow of a firm is crucial because it reveals how much money is available for bill payment, new project investment, and shareholder distribution. A company with a negative cash flow can be forced to take out a business loan or sell assets to acquire money, both of which can be expensive and lead to future financial issues.

Although they are two distinct concepts, profitability and cash flow are sometimes conflated. A business might be successful while yet having negative cash flow, which means it is not bringing in enough money to pay its costs. On the other hand, a company can be successful and yet have a positive cash flow if its sales are insufficient to meet its expenses.

Both cash flow and profitability should be considered in order to determine a company’s financial health.

Why Is Cash Flow Important?

Money is vanity, profits are sanity, and cash is reality, according to business lore. Simply put, managing finances begins with cash. Your activities will be halted if your company is not making enough money to meet all of its expenses.

The lifeblood of any firm is cash flow. It is important to carefully manage the money that enters and leaves a company in order to make sure it can continue to run. Without sufficient cash flow, a company may quickly have financial difficulties and can even have to close. Because of this, it’s crucial to monitor your company’s cash flow and to ensure that you have a solid grasp of where the money is coming from and going.

The importance of cash flow can be attributed to a variety of factors. First of all, it can assist you in avoiding financial issues. You can identify any possible issues early on and take action to address them before they worsen if you closely monitor your cash flow.

Second, cash flow can support corporate expansion. You may make sure you have the funds you require to invest in new goods, recruit new personnel, or grow into new areas by properly controlling your cash flow.

Finally, cash flow is a reliable sign of how well your company is doing. A robust cash flow indicates that business operations are going smoothly. If it’s not, that can mean there’s a problem and you need to do something to remedy it.

Cash Flow Issues

Some business owners experience typical cash flow issues. Business owners may need to take a proactive approach to managing cash flow, and ideally avoid such issues, if they are aware of what these issues really are. To prevent any future issues, established businesses must keep an eye on how cash moves across the organization.

When a business has more money going out than coming in, it has a cash flow issue. This may occur for a variety of reasons, including when a company invests in new initiatives or product lines or when it is expanding quickly.

A business may experience cash flow issues if it must pay for unforeseen expenses like a lawsuit or a natural disaster. An organization may need to sell assets or take out loans if it does not have enough cash on hand to fulfil its expenses.

Being forced to make difficult decisions about how to distribute a company’s limited resources, cash flow issues can be challenging to resolve. In some circumstances, a company may need to fire employees or sell assets to raise money. In other situations, a company might be able to raise capital by issuing fresh equity or borrowing money.

For firms, cash flow issues can pose a significant danger because they can easily get out of hand. Unwise business decisions could lead to bankruptcy. Companies must plan ahead and ensure they have enough cash on hand to fulfill their expenses, if they want to prevent cash flow issues. Additionally, they must exercise caution while taking on excessive debt.

Cash Flow Management Concept

Monitoring, analyzing, and projecting a company’s cash inflows and outflows is the process of cash flow management. Making sure a business has enough cash on hand to cover short-term obligations, and as well as enough to invest in long-term growth prospects is the aim of cash flow management.

Budgeting, cash forecasting, and working capital management are just a few of the several methods that may be utilized to manage cash flow.

Budgeting

The process of preparing a company’s financial plan is known as budgeting. A cash flow budget is a forecast of your company’s cash flow over a specific time period. Analyzing this data is crucial to determining whether you have enough cash flow to support ongoing operations. Additionally, you can utilize it to decide how best to distribute your budget. This is the process of putting together a company’s financial strategy. A budget will include projected amounts for income, expenses, and cash flow.

Cash Forecasting

The process of predicting a company’s upcoming cash inflows and outflows is known as cash forecasting. Making judgments regarding how to most effectively use money can be done with this information.

Capital Management

The practise of managing a company’s current assets and obligations is known as working capital management. Making sure a business has enough cash on hand to cover short-term obligations as well as enough to invest in long-term growth prospects is the aim of capital management. This involves controlling the amount of inventory as well as the accounts payable and receivable.

Cash Flow Monitoring and Management

You must remain current with your bookkeeping. It’s critical to maintain records. It will be the sole source of financial data for your company. This can be handled by the accountants. As an alternative, you might perform computations using software or spreadsheets. Even so, you might be able to improve the analysis by taking a look at your company’s projected financial position. Utilize this data to examine your company’s cash flow.

There are many strategies to increase cash flow, including simplifying invoices and payments, providing incentives for early settlement, and following up on unpaid invoices. A small firm can prevent the financial issues that can so easily result in collapse by managing cash flow.

If you use an accounting software, managing and monitoring your cash flow is simple. You can see where your money is coming in and going out by looking at the cash flow reports the software will give you.

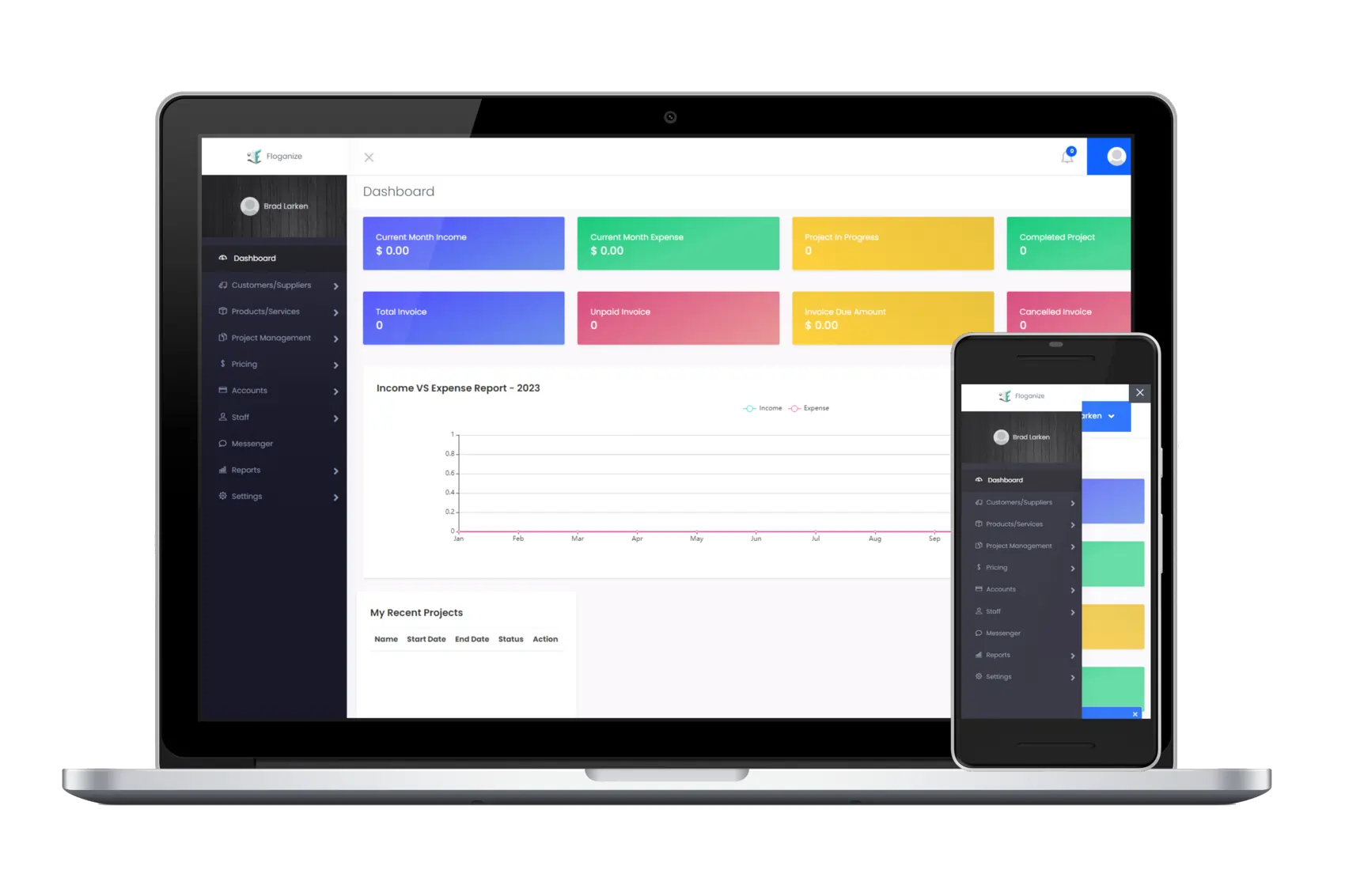

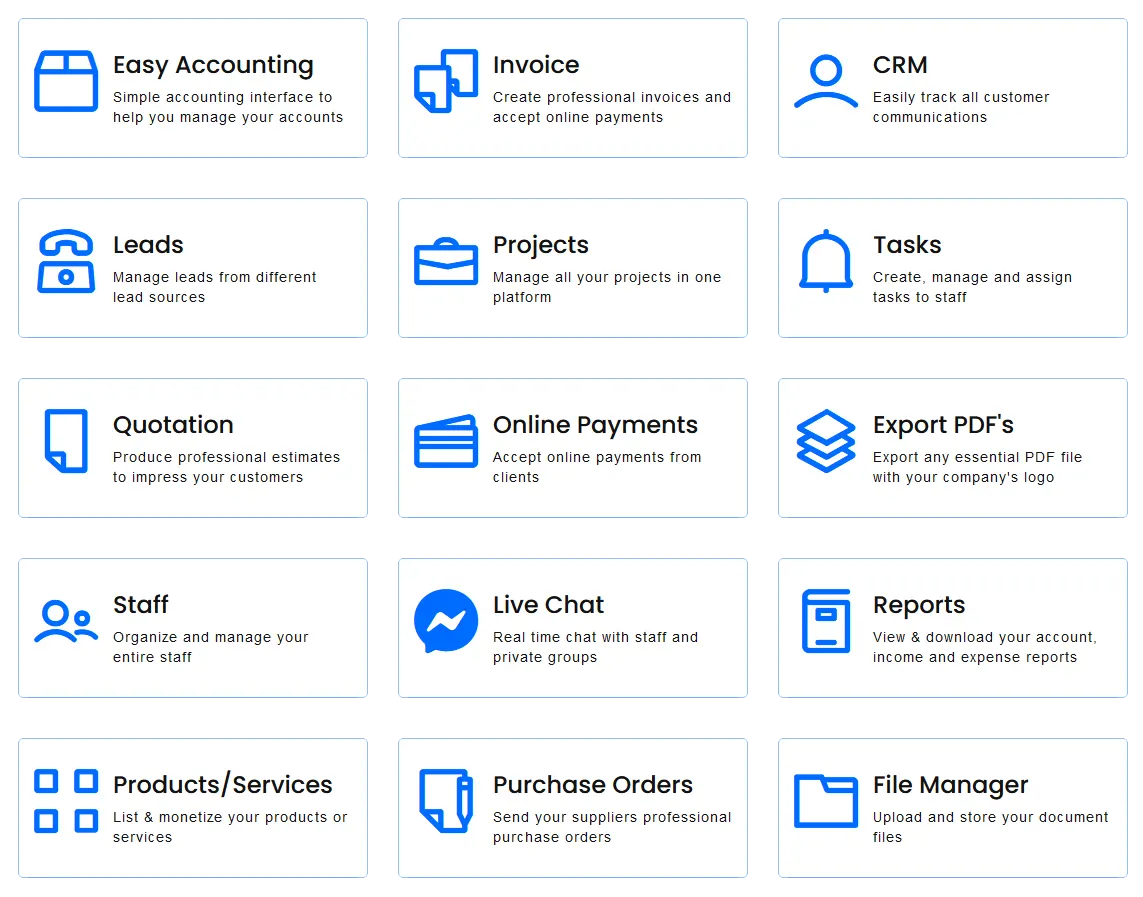

Floganize Accounting Management Software

Floganize is a comprehensive business management tool that aids in handling critical business tasks including workforce management and accountancy.

You can quickly and effectively track invoices and expenses for your small business using Floganize. It makes managing your money simple and enables you to keep track of all of your earnings and outgoings in one location. By relieving yourself of time-consuming bookkeeping duties with the aid of this cloud-based solution, your firm may expand more successfully.

The following finance features of the accounting app are helpful:

– Invoices:

You may quickly produce invoices with a professional appearance using this program. Invoices are saved in your profile during the creation process so you may access them later, email them to clients, and keep a copy for accounting purposes. Because Floganize makes the accounting process simpler, business owners can track, manage, and issue invoices fast. The firm benefits from this procedure as well because it ensures prompt payment.

– Quotations:

Track the conversion of your client quotes into invoices paid to your company by keeping track of them in one location. Quote management is an essential component of your organization since it predicts the sales runway when customers are prepared to inquire about your services. It is advantageous to keep internal track of your quotes so that you may concentrate more on your sales.

– Tracking Expenses:

Software for tracking spending makes the process simpler. It offers helpful information that may be utilized to make reports, submit taxes, or for other things like keeping track of finances and real-time monitoring of business spending.

View the Floganize Tutorials Section to Learn More

If you want to learn more about our powerful business management software, then please click here to view the Floganize tutorials educational page. You can sign up today for a free 14-day trial! Simply click here and enjoy all of the powerful features that will simplify your daily business tasks!